It’s no surprise that different financial views in a relationship can cause friction between partners. The following article by finance expert

It’s no surprise that different financial views in a relationship can cause friction between partners. The following article by finance expert

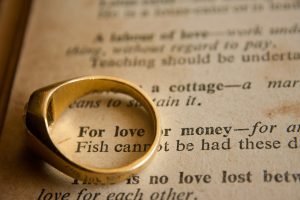

Money mistakes that ruin marriage

By David Koch (News Corp Australia) July 14, 2014

IF you and your partner don’t want to be a divorce statistic, there are a few matters to sort out before walking down the aisle.

Research suggests the way you and your spouse handle money is a significant predictor of whether you’ll have a long-lasting marriage.

When a couple decides to get hitched, chances are neither party is basing their decision on how financially compatible they are together. At least we hope that’s not the case … we’re romantics at heart. But once the dregs of the wedding cake have finally been thrown away and the honeymoon snaps are safely in their frames, how you deal with money as a couple becomes a critical consideration.

Financial incompatibility and pressure is one of the top factors behind 50,000 couples divorcing in Australia every year, so it’s a good idea to talk about money well before the big day. To guide the conversation, here are five financial matters to get sorted before walking down the aisle.

Be open about money

If you don’t form good habits early on in a relationship then the bad ones will stick with you. This means you’ve got to start out being open and honest about your financial situation as soon as things get serious. You’ve already made the decision to spend the rest of your life together, so there should be enough trust to share things like your salary and any dirty debts you’ve picked up along the way. Otherwise, that hidden income or concealed credit card will cause problems when it’s inevitably discovered.

Understand each other’s values and goals

It’s important for each person to understand what the other wants to achieve financially, both in the relationship and for themselves.

Don’t expect to be 100 per cent aligned on everything; there’s no right or wrong answer, and words like security, lifestyle and comfort mean different things to different people.

But once you’re on the same page it makes managing money so much easier, from everyday issues like choosing a restaurant to tough decisions like how much to spend on a house or where to send the kids to school.

Related Article: What happens to my finances if I split up with my de facto?

Line up spending habits

If one person is squirrelling away every spare dollar while the other is consistently blowing their pay cheque on the latest ‘must haves’, then sooner or later things will come to conflict.

This can be avoided by making sure your spending habits are compatible. A budget will help here, as will understanding each other’s goals.

We’ve met so many couples who, through being disciplined with their money and working towards the same goals, have ended up with more wealth than those who earn three or four times as much but spend the lot.

The joint account

While it’s certainly not essential to have joint banking accounts, they can make the process of managing money simpler, more transparent and fair … Think splitting bills, buying groceries and paying the rent or mortgage. And if you spend less time arguing about money, then you can spend more time enjoying your relationship.

To make a joint account work, a good option is to set up three accounts: yours, theirs and the joint account, with wages deposited into your individual accounts.

Then look at what you both earn and set up an automatic transfer for a certain percentage (to keep things fair) of each wage into the joint account each month.

If only one partner earns, you’ll need to work backward. Deposit the entire wage into the joint account first, then transfer money into each individual account.

Don’t be financially ignorant

For two people to jointly manage their finances, each partner must have a basic understanding of money. Start by opening your eyes and ears to financial news … Daily newspapers, television, radio and books on money can all provide enormous help. For more complex matters, it can be extremely helpful to see a financial planner together.

By squaring up your financial relationship before tying the knot, you can avoid conflict later and build a brighter future together.

For information on how you can separate and divorce with or without court please contact our office – 03 9620 0088 or email info@resolveconflict.com.au